Localization & tax reporting

Navigate global transactions with ease

Our platform provides a holistic solution that simplifies localization and tax management for clients worldwide, making global transactions a breeze.

Provide localized content in 39 languages, with the flexibility to add more as needed.

Manage templated key phrases across platforms using an easy-to-use interface and quick localizing capability.

Leverage version management for simple deployment, ensuring smooth updates to your website.

Export and upload PO files for integration with any third-party localization software.

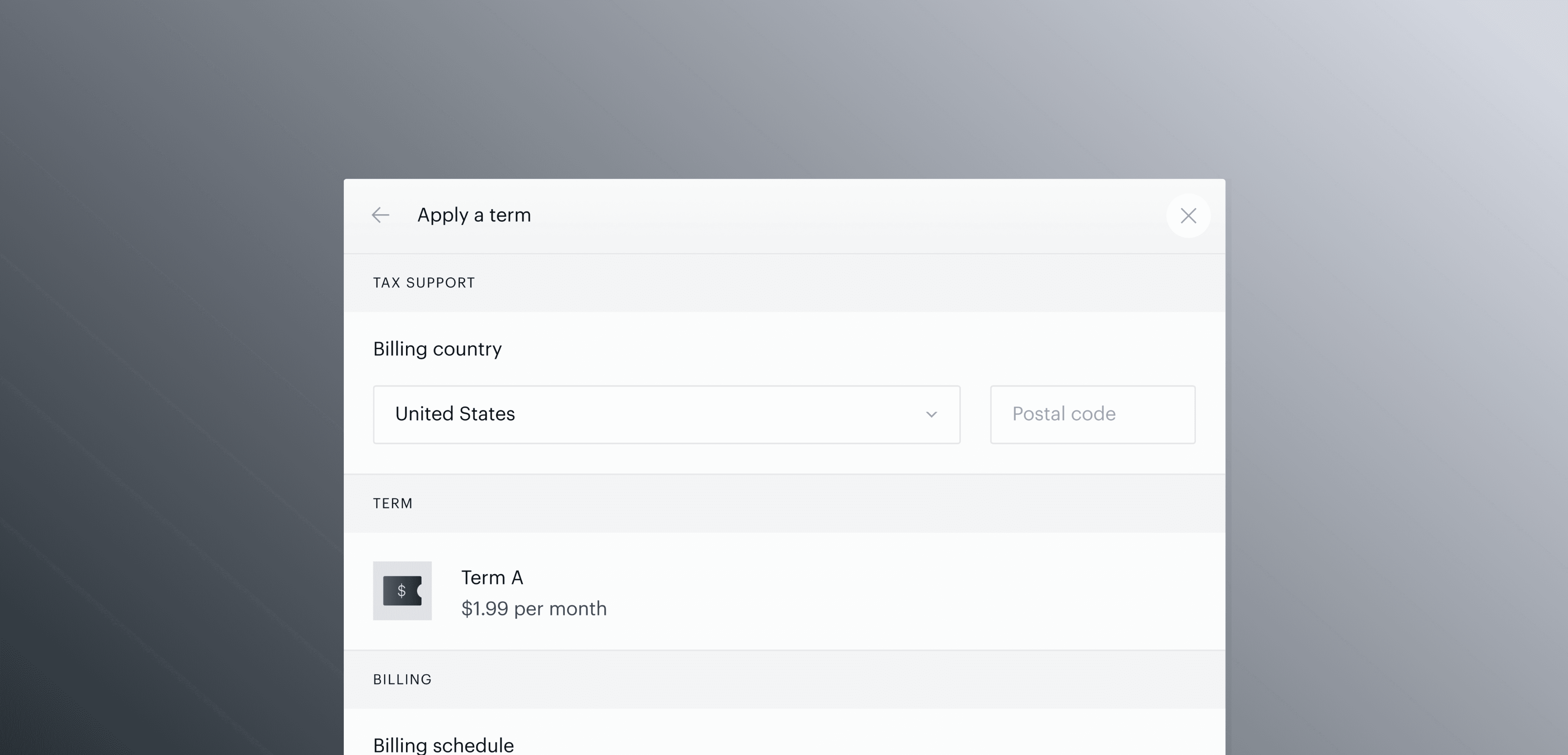

Configure Sales Tax, VAT, GST or custom settings for each application.

Automatically calculate inclusive or exclusive Sales Tax, VAT, GST on all digital sales.

Calculate, display, collect and report on taxes on both end-user interfaces and Piano's dashboard.

Enable address validation for US and CA transactions with Experian or Avalara.

Leverage 3rd party tax providers such as Avalara, TaxJar and OneSource to unlock more tax features for product category management, reduced rates, tax exempt sales or automated transaction recording for further tax filling purposes.